Understanding the Court’s Power and How to Protect Yourself One of the most common assumptions in family law is that everyone pays their own legal costs.…

Binding Child Support Agreement, Assessment & Laws

Child Support Agreement: Child support is governed by the legislative instruments of the Child Support (Registration and Collection) Act 1988 and the Child Support (Assessment) Act 1989.

Separating from a partner or spouse either through a divorce or the end of a de facto relationship is often the most difficult and emotional process a person can go through. This is especially true when young children are involved.

The Commonwealth Child Support Laws are designed to ensure the interests and wellbeing of children are satisfied, by balancing the parenting arrangements of the parties and the capacity of each party to support the child. As many situations are unique, determining the appropriate option for your situation often requires legal expertise and advice.

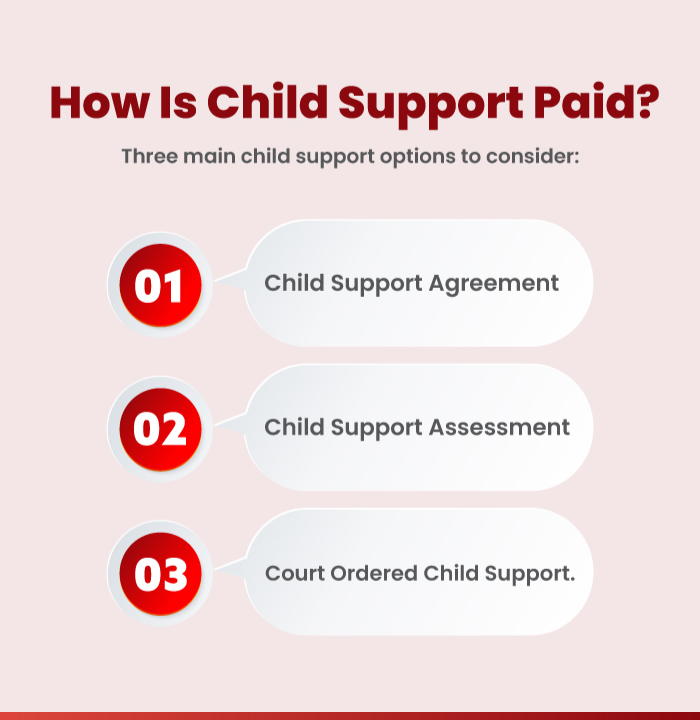

How is child support is paid?

There are different forms of child support arrangements which the parties may enter into, each depending on your current financial position. It is also possible for the parties to willingly negotiate the terms of how child support is paid. However, generally, there are three main child support options to consider:

Child Support Agreement;

Child Support Agreement;- Child Support Assessment; and

- Court Ordered Child Support.

1. Child support agreement

Child support agreement occurs when both parties can reach an agreement on how much child support is to be paid. This agreement often takes the form of a written agreement that outlines the terms and conditions of how and when this payment will occur.

The agreement can then be registered with the Department of Human Services (Child Support), otherwise known as the Child Support Agency, who can then collect and distribute the payment pursuant to the agreement.

If one party receives Centrelink or government benefits, then any child support set out in an agreement must be in excess of what the parties would pay by way of child support if the matter had been assessed by the Registrar of the Child Support Agency.

If the parties are both in employment and receiving an income, and apart from the care benefits of Centrelink for children, the parties can make their own arrangements in regard to the financial support of the children, and this can be set out in a child support agreement.

There are typically two forms of child support agreement:

1. Binding Agreement –This category of agreement allows the parties to determine the amount of support to be paid without requiring a formal assessment from the Child Support Agency.

The amount of child support that is paid to one party may be less than the amount otherwise assessed by the agency. These payments may also be the in form of a lump sum, as opposed to weekly installments.

It is important to obtain independent legal advice before signing a binding agreement. With a binding child support agreement, the solicitors sign a certificate attached to the agreement confirming that advice has been provided.

A binding child support agreement is difficult to set aside, as this document can only be revoked or varied by application to the Family Court if signed.

2. Limited Agreement –This category of the agreement requires the parties to have child support contributions assessed by the Child Support Agency prior to the agreement.

The allocated child support payment must therefore not be less than the assessed amount. Importantly, you are required to obtain legal advice. The parties may terminate the agreement at the conclusion of three years, or, earlier is circumstances change significantly.

2. Child Support Assessment

Child Support Assessment, being the second child support option, is the most common arrangement between two parties. Child support is governed by the Child Support Agency, a federal statutory body that is independent of the judicial system. The Family Court does not generally have the power to deal with an application for the maintenance of a child nor order a party to pay child support.

All applications for child support are directed to the Child Support Agency. The Registrar issues an assessment based on the income tax return of the parties which are disclosed through family law proceedings and based on the care arrangement of the child or children.

This option involves an assessment undertaken by the Child Support Agency according to one set formula provided for under the legislation. This formula takes into consideration both parties’ respective incomes, the parenting arrangement for the child or children, the amount each party owes to the other and how much time the parties spend with the children.

The Child Support Agency after making an assessment will collect money from one party and distribute to the other. Assessments are automatically reviewed and re-assessed by the Agency after approximately 15 months.

Each party has the right to appeal any decision made by the Registrar in respect to referral to the Child Support Agency.

However, if a party appeals the decision, and this appeal is dismissed or struck out, pursuant to the legislation, the party must apply to the Family Law Court to hear an application to vary or dismiss a child support arrangement which has been decided by the Child Support Agency.

Once the Child Support Agency has made a decision regarding a child support assessment, each party has the right to object to the decision pursuant to section 80 of the Child Support Assessment Act.

This objection must be lodged with the Agency within 28 days of the original decision being lodged and outline the grounds on which the objection is based. If an objection is lodged, the other party will be provided the opportunity to respond.

Once the Registrar has made a decision regarding the objection, this must be provided to both parties in writing pursuant to section 87 of the Child Support (Assessment) Act.

Once the Registrar has made a decision regarding the objection, this must be provided to both parties in writing pursuant to section 87 of the Child Support (Assessment) Act.

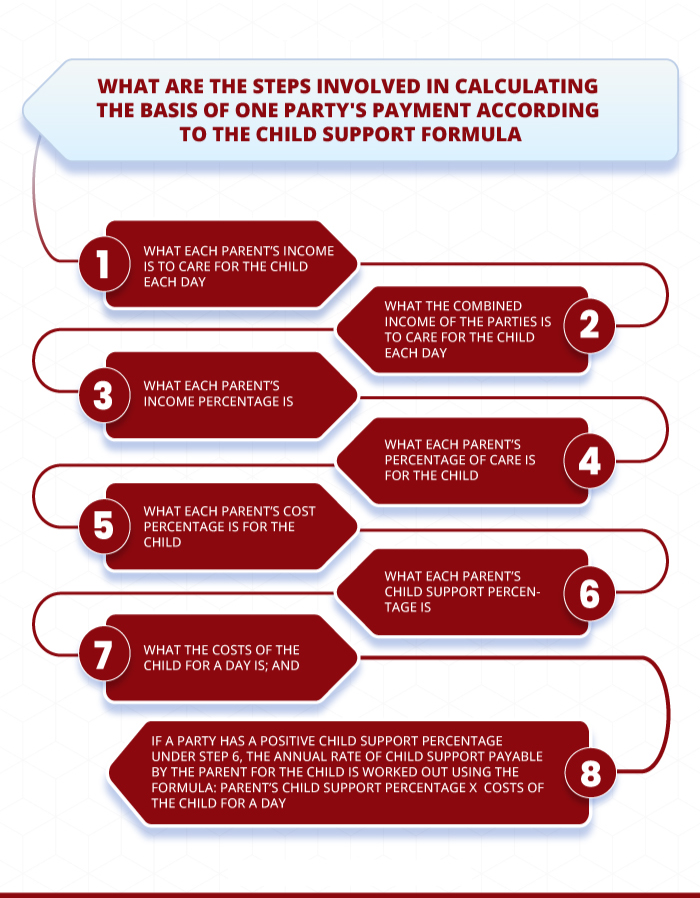

According to the child support formula, there are eight steps to calculating the basis of one parties’ payment:

- What each parent’s income is to care for the child each day;

- What the combined income of the parties is to care for the child each day;

- What each parent’s income percentage is;

- What each parent’s percentage of care is for the child;

- What each parent’s cost percentage is for the child;

- What each parent’s child support percentage is;

- What the costs of the child for a day is; and

- If a party has a positive child support percentage under step 6, the annual rate of child support payable by the parent for the child is worked out using the formula: Parent’s child support percentage x Costs of the child for a day

3. Court Ordered Child Support

The third and final option involves obtaining Court Ordered Child Support. An application is able to be brought by a party before the Family Law Court seeking a child support payment, provided the child in question is over the age of 18.

This application is known as “child maintenance” and often arises where one party has the responsibility of a child with a disability or similar circumstance.

Both biological and adoptive parents of a child may be liable to pay child support to another parent or person. If a party is seeking child support through the Child Support Agency, the evidence must be provided that the other party is the parent of the child.

If you are unable to obtain this proof, or if there is some other dispute regarding the child’s paternity, DNA testing will be required.

Any parent who cares for their child for at least 35% of the allocated time (being within 12 months from the date the assessment commences) may apply for a child support assessment.

The amount a party may receive under this assessment is dependant upon the set formula. Importantly, a party is unable to claim child support in circumstances where the other parents continue to live that person on a genuine domestic basis.

However, this is not limited to biological parents alone. Any person who is a non-parent carer (such a grandparent or family members) who has the care of the child, is able to claim payment from one or both parents of the child, provided the case for the child 35% of the allocated time, and, are the legal guardian of the child.

Child support fails

If the party who is obligated to pay child support fails to do so as per the registered agreement or by the child support assessment, the Registrar has wide powers to obtain payments by other administrative methods such as:

1. Compelling the person’s employer to make payment directly to the Agency;

2. Recovering payments from social security benefits and Family Tax Benefits;

3. Intercepting the person’s tax refund.

If the Registrar is unable to secure payment through the abovementioned administrative means, then the Registrar may apply for Court Orders to enforce the debt.

Child Support, What Is It Really Used For?

This financial assistance is often in the form of a monetary payment on a systematic basis, such as weekly, fortnightly, or monthly installments. The amount of child support paid by a party is relevant only to the costs incurred by the primary caregiver to provide an adequate standard of living for the child or children residing in their care.

This includes money for food, clothing, schooling, and general care. This amount does not include any excess which would be used by the other party for their own personal care. Money that is paid towards the other party’s care is known as “Spousal Maintenance”, and, remains distinct from child support.

What child support agreement includes?

Although there is no “setlist” of what a child support agreement includes, the biggest disagreement between the parties commonly arises over whether this financial support should include mobile phones, other inessential technology, costs of transportation, and extra-curricular activities.

A major concern amongst parents who have children under their care is the payment and costs associated with extra-curricular activities. As sport, music, dance, and other similar activities are popular with children of all ages, the costs associated with these can be quite significant over a long period of time.

Unlike child support payments which are determined upon set criteria and formula, non-periodic payments associated with extra-curricular activities do not have a ‘one size fits all’ answer for which party pays and in what proportions.

As is the case with many families, the child’s involvement in extra-curricular activities often brings great joy, accomplishment, and pride to both the parents and children.

Therefore, when determining how these activities are to be paid for between the parties, it is essential to keep the best interests of the child in mind, and whether an equitable solution can be reached. This approach often priorities the children’s continued emotional wellbeing and development rather than something the parents can hold over each other and fight about.

Payment of school fees and extra-curricular activities of the children post-separation can often feel burdensome on one party, especially in situations where the other party is refusing to contribute.

If you remain at an impasse with the other party about financial arrangements for these categories, mediation is the best course of action. This process often results in the parties reaching a compromise on issues such as extra-curricular activities, payment of insurance and medical bills, cost of school items (uniforms, books, equipment, etc.), and school fees.

If a parent does not agree with the amount of child support being paid either by them or to them, mediation and negotiation is the first point of order between the parties.

If an agreement is unable to be reached, the Child Support Agency has a review/amendment process which can be sought to determine whether the amount paid is appropriate. If the mediation process fails, a party may apply to the Child Support Agency who has the authority to determine which party is responsible for the payment of private school fees and how this payment is to be shared. If a party disagrees with the ruling made by this Agency, a review process is available.

There has generally been a disposition in society’s understanding of child support that the Court will always award the mother with primary custody which entitles her to receive financial support from the father.

This is simply incorrect. Each case is unique, and, requires careful consideration of the facts to determine the arrangement which is in the best interests of the child.

Australia has numerous existing child support arrangements within the international community. This is referred to as a reciprocating jurisdiction under section 29B of the Child Support (Assessment) Act.

Under this legislation, the Agency is able to make and continue a child support assessment where the party resides overseas in a reciprocating jurisdiction, provided the other parent is resident in Australia. The Agency has further powers in relation to:

1. Registering and enforcing an overseas maintenance assessment;

2. Registering and enforcing an overseas maintenance order;

3. Registering and enforcing an overseas ‘agency reimbursement liability’;

4. Registering and enforcing arrears that have accumulated under any of the above;

5. Transmit an application for review/variation of liability made; and

6. Assist overseas authorities with location and service requests for Australian parties.

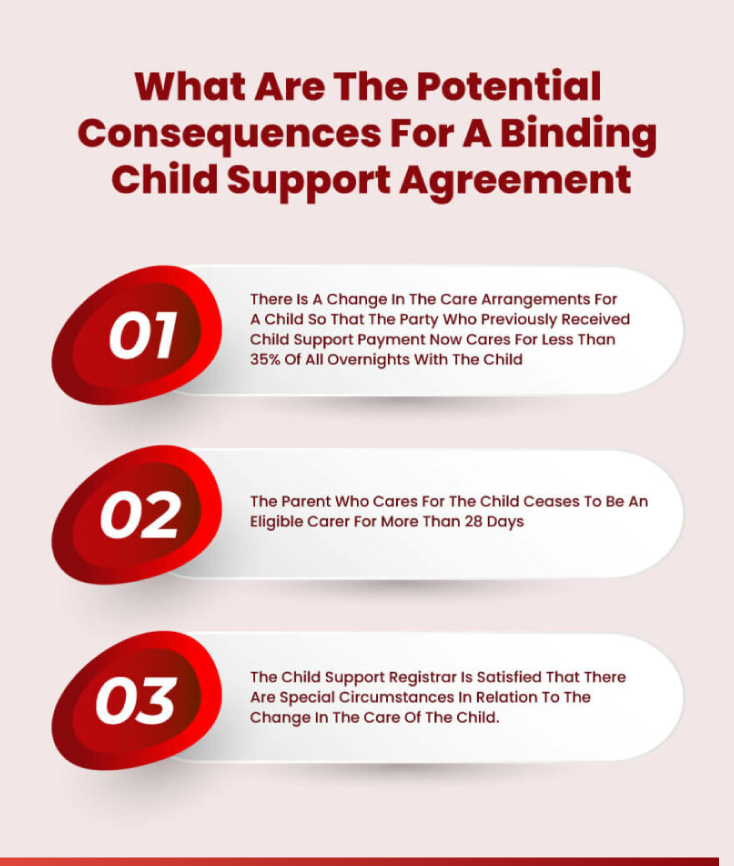

Recent amendments to the Child Support (Assessment) Act may have a significant impact on current and future binding child support agreement made between parties.

The recent changes through the implementation of the Family Assistance and Child Support Legislation Amendment (Protecting Children) Bill 2018 will directly affect parties who enter into a binding child support agreement that finalises child support without the adoption of the formula provided for by the Child Support Agency assessment. These changes are retrospective, which means agreements entered into prior to this amendment will still be affected.

Essentially, these changes may result in the binding child support agreement to be suspended or even terminated in circumstances where:

Essentially, these changes may result in the binding child support agreement to be suspended or even terminated in circumstances where:

- There is a change in the care arrangements for a child so that the party who previously received child support payment now cares for less than 35% of all overnights with the child;

- The parent who cares for the child ceases to be an eligible carer for more than 28 days; or

- The Child Support Registrar is satisfied that there are special circumstances in relation to the change in the care of the child.

Importantly, if the care arrangements only change for one child to which the binding child support agreement relates, but not other children, the binding child support agreement will be suspended or terminated in the context which relates to that child.

It will continue to operate as intended in relation to other children, provided the parent continues to be an eligible carer of that child/ren. If you have a binding child support agreement that was signed before 01 July 2018, we strongly advise that you contact our office to review this agreement and ensure it remains binding in the future.

This is essential to avoid the agreement being suspended or terminated as a result of the new legislative changes to the Child Support (Assessment) Act.

Alternatively, if you find that an agreement cannot be reached and you need legal advice regarding your options, please do not hesitate to speak with one of our accredited family law specialists today.

At James Noble Law, our first and foremost position is to promote mediation between the parties, to allow for future negotiations and parenting arrangements to be similarly resolved.

In search of legal guidance?

Your quest ends here! Uncover the excellence of James Noble Law, serving the realms of Family Lawyers in Brisbane, Family Lawyers in Cairns, and Gold Coast Family Lawyers. Our adept legal team is geared up to provide you with a complimentary 20-minute consultation – no strings attached! Secure your spot now for a discussion with our seasoned Family Lawyers.

Explore:

🌟Accomplished Brisbane Family Lawyers 🌟 Committed Cairns Family Lawyers 🌟 Skilled Milton Family Lawyers

Effortlessly pinpoint our location on Google Maps and commence the journey to resolve your legal matters with confidence. Don’t delay – take the initial step towards tranquility today!

Helpful Family Law Documents & Guides

- A Guide to Children Negotiation and Family Law

- A Guide to Property & Family Law Act Paper

- A Guide to Alternative Dispute Resolutions

- A Guide to Preparing for the unthinkable

- A Guide to Collaborative Practice Paper

- A Guide to Separation in Family Law

- A Guide to Family Law Property

- A Guide to Dispute Resolution

- A-Z Collaborative Law eBook

- A Guide to Separation

- A Guide to Children

- Arbitration eBook

Need Help?

Talk to a Noble Family Lawyer

Family Law News

Keep up to date and receive clarity on a range of news related articles on the James Noble Law blog.

When family law disputes escalate, concerns about safety, communication, and children’s wellbeing often arise quickly. Many people assume that restraining orders can only be made…

Filing an Initiating Application for parenting orders can feel urgent and overwhelming especially when children are involved. However, many parents are surprised to learn that…

Child Support Agreement;

Child Support Agreement;